Here is Amazon’s explanation of last week’s cloudburst.

I don’t pretend to understand it, so here is a wordle of the account (click image for larger):

Here is Amazon’s explanation of last week’s cloudburst.

I don’t pretend to understand it, so here is a wordle of the account (click image for larger):

$2B to $5B is Eqecat’s estimate.

So far, it’s the busiest tornado season ever, as this NOAA chart shows:

It’s a bit tough to read, but the chart shows the cumulative number of tornadoes in a year. The black, incomplete line shows this year’s activity. The fact that it is higher at end-April than all the other lines means there have been more tornadoes in the U.S. this year (835 through April 28) than in any previous year at this juncture. (Previous record: 556.)

(Incidentally, the words inflation-adjusted in the chart title refer to NOAA’s adjustment for the fact that better reporting nowadays means more tornadoes are reported. NOAA in essence is making the chart an apples-to-apples comparison.)

In other news, Eqecat points out the rain those storms dumped is making its way to the nation’s rivers. The Ohio River and the Mississippi south of Cairo, Ill., are well above flood stage, with more to come.

And wildfires in Texas have probably created $100 million in insured losses.

If you’ve been busy, headlines and links to keep you up to date:

I’ll try to do this every Friday and since you’re busy, I’ll try to limit it to the most important stuff, plus the week’s viral video, which this week happens to be insurance-related:

Viral: Tornado strikes Tuscaloosa

Wherein I chide Felix Salmon, the fine Reuters financial blogger, for his views on the cat market.

Mind you, I agree with his conclusion – that the catastrophe bond market is likely to remain small compared to the catastrophe reinsurance market. I just disagree with his reasoning.

Salmon is playing off of a Business Week article that describes nicely what a catastrophe bond is:

An insurance company issues bonds to financial investors, such as hedge and pension funds, that are willing to place a bet on the probability of a disaster occurring at a particular location and during a specific time frame. During the life of the bond, the insurer pays investors a coupon interest rate. If nothing happens, the insurer returns the money when the bond matures. If the fates are cruel, cat bond investors kiss off all or part of the principal.

And this is newsy because defaulting cat bonds will fund well less than 5% of the estimated $30B or so in Japan earthquake/tsunami losses.

Salmon maintains that “catastrophe bonds are the capital-markets security of the future, and they always will be,” maintaining that:

I agree that cat bonds won’t dominate the markets, and basis risk is a big reason.

But I don’t think the former point holds up well. The catastrophe reinsurance business can have very attractive returns; however, you have to accept variability in those returns. The purest example of catastrophe reinsurance is probably Renaissance Re, and it has an average ROE of 23% since its formation in 1993, according to this investor presentation (pdf), found here. That’s a bit better than the typical cat bond, which has returns around eight percentage points above Libor, according to this Business Insurance article.

And traditional cat reinsurance should have better returns, because cat bonds bear less risk. Few Japan bonds defaulted because most had triggers tied to earthquakes closer to Tokyo. And in general, cat bonds are structured so the probability of default is remote. From the Business Week article:

“It’s almost like hole-in-one insurance,” says Nelson Seo, co-founder of Fermat Capital Management in Westport, Conn., which oversees about $2 billion, including cat bonds. “It’s been very good returns, and most of the investors in this space have been very happy with it.”

Bond investors don’t like defaults, and a cat bond structured to default when, say, a Category 2 hurricane hit Florida wouldn’t find much market support.

That fact by itself means most catastrophe losses will remain in the (re)insurance industry. Beyond that, I’m told, cat bonds are more difficult to structure than traditional reinsurance treaties, particularly if the bonds are subject to regulatory scrutiny.

A reinsurance treaty, by contrast, is a contract among a half-dozen parties, perhaps fewer. As the reinsurance world is small, the parties know each other well. The contracts are highly standardized, swapping in well-known clauses that vary in predictable ways. Processing the paperwork is relatively easy – so easy that it’s easy to forget to do it. The industry has needed policing to ensure that the contracts get signed promptly.

Besides, quite a few hedge-fund managers like the returns on cat reinsurance, even at lower layers. They embrace the variability since it is lightly correlated with overall market returns.

They can invest directly in a company or fund a sidecar – a short-term reinsurance company that takes a portion of the catastrophe business that a larger reinsurer writes. Alterra recently created one with Stone Point Capital, a private equity firm, in the wake of the Japan earthquake.

The bonds do have their place – they let reinsurers lay off their accumulated risk in extreme events, like a Tokyo earthquake. And like Salmon, I don’t think they will ever replace reinsurance. However I think the reasons have a lot to do with probability of default and less with the promised returns.

Confusing article in Saturday’s New York Times about insurance offered by Zipcar’s car-sharing service.

(Zipcar is a car rental firm that targets the urban customer who rarely needs a car. Think of someone who lives in Manhattan, Center City Philly or near Chicago’s Loop. A customer pays an annual fee to buy the right to rent a car from one of Zipcar’s lots, located near the customer’s residence. Instead of renting by the day or week, Zipcar rentals usually run just a couple of hours – perfect for a shopping trip or a jaunt to the ‘burbs for a friends’ barbecue.)

The NYT complaint: Zipcar’s liability coverage has a limit of ‘only’ $300,000 per accident, “no matter how many people they may hurt.”

If you spend any time in the personal auto space, you see the issue immediately: Few auto owners buy more than $300K coverage. Most states require $50K to $60K limit.

More to the point:

Shouldn’t Zipcar be praised, not scolded?

Not to the Times’ Ron Lieber, whose column in addition takes on another car-rental leader:

Zipcar and Hertz car-sharing drivers, however, ought to consider the worst case. That’s what insurance is supposed to be for, after all, and neither company’s coverage protects people from it. Would it be so hard to give customers the option to buy a lot more coverage for a bit more money?

Zipcar has known about this issue for many years. I first wrote about it in a Wall Street Journal column in 2005, when the liability coverage was identical to Hertz’s current offering. Felix Salmon, a blogger for Reuters, has periodically hammered away at Zipcar since that time, too.

The Times states, correctly, that a person worth $1M+ won’t be shielded by a mere $300K limit and finds attorneys who agree that, yes, they would sue an at-fault rich guy for more than $300K. And it notes that people with that kind of money ought to have a personal umbrella policy, anyhow.

And it points out the data are on Zipcar’s side:

According to a Zipcar spokeswoman, Colleen McCormick, the $300,000 in coverage has been adequate for every accident since it began operations. She added that more than half of accidents involve only the Zipcar vehicle itself. When another car is involved, 93 percent of the accidents have resulted in claims of less than $10,000, and 99.3 percent result in claims of less than $50,000.

That makes the company pretty lucky. Sure, accidents with injuries are rare, but what happens when they do occur? According to ISO, a data provider to insurance companies, about 2 percent of bodily injury liability insurance claims in the United States are for more than $300,000; in the State of New York, it’s 3 percent.

Lucky? Don’t have the data to really analyze this, but I’d guess that a decade-old company with enough short-trip customers to float a well-received IPO probably has more credible experience regarding its customer base than ISO. And I’d be surprised if ISO disagreed.

For an interesting discussion of this subject, check the comments to the Times’ Bucks blog. Comment 13 (Bimmer) nails it:

This is really making an issue out of not much. There are many people driving around their own cars with far less than $300K in liability coverage. So Zipcar offering $300K is actually more than I would have expected.

The fact that they’ve never had an accident that’s exceeded $300K is actually pretty meaningful, despite your dismissing it as nothing.

If you have moderately significant assets, then you should have some sort of insurance like homeowners or auto or something that you can easily add an umbrella policy to. That’s the answer – not Zipcar redoing what’s working just fine for its members now.

Not clear how much of this is post Japan earthquake.

I chirp to thee:

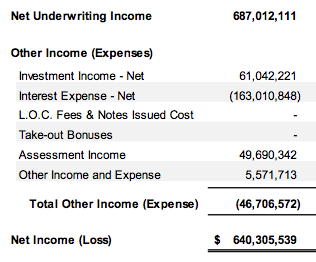

Actuarial Outpost has picked up my post about how Florida’s state HO insurer, Citizens Property, can’t remain solvent through a substantial storm. The very sensible Outpost question – what about the investment income?

Unfortunately, as this snip from the 2011 budget (around page 12 of this pdf) shows, Citizens posts net investment losses:

That line that says assessment refers to a 1.4% surcharge to cover the last time Citizens went bust, in 2005. More about that in a minute.

That line that says assessment refers to a 1.4% surcharge to cover the last time Citizens went bust, in 2005. More about that in a minute.

The insurer is paying off its loans at interest rates between 1.28% and 5.3074% – not bad, but you can’t get that on short-term paper these days. I glanced at Schedule D of the 2010 Annual Statement (pdf), and it looks like the majority of the bonds Citizens holds mature in less than a year, which you’d expect from an organization that needs all its surplus handy for the Big One.

Unfortunately, the bulk of what Citizens owes is due after 2015, as Outposter silverfox documented. So Citizens is borrowing long and investing short, which is a hard way to make money.

But if the Big One hits, they apparently won’t be borrowing more. Poking around a bit more on the Citizens web site, I found this 2009 presentation to rating agencies that says “Post‐event bonding unlikely for Citizens even in a 1‐100 year loss scenario.”

The statement appears to reflect Citizens’ “sales-tax like assessment capability” – their words, not mine – on most insurance premiums in the state for 30 years. But I don’t see how that would keep them from borrowing to make sure they had the cash to pay claims. Knowledgeable comments would be welcome.

As for me, I’ll take them at their word. You don’t lie to the rating agencies.

Of course, Citizens’ PMLs have been rising, as I said a couple of days ago. In the presentation to the ratings agencies the 1-in-100 event storm was $13.9B then (slide 30). Now it is over $20B gross and about $17B net, according to this presentation (pdf) the insurer made to the state House Banking Committee in January. Here’s a nifty snip from slide 23 showing how a 1-in-100 storm would be paid for:

(HRA is high-risk wind. PLA and CLA are personal and commercial accounts that have less wind exposure.)

As you can see, surplus gets depleted first. For the rest, the Florida cat fund (FHCF) steps up, then Citizens customers get dunned, followed by the assessments.

Of course, if the storm hits, say, this year, there will be another round of assessments on top of the ones from 2005. And the underlying rates could rise too, so Floridians would be paying for the last two storms while buying insurance against the next one. Sounds expensive to me.

I prefer the system where you pay premium up front. Then, if tragedy strikes you are covered – not taxed.

Shouldn’t have been surprised by this one. Bloomberg with the call, via Business Week:

April 20 (Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc. will get $1.65 billion from American International Group Inc. for assuming the risk of asbestos policies from the bailed- out insurer.

The deal with Omaha, Nebraska-based Berkshire’s National Indemnity will result in a deferred pretax gain of $200 million this quarter, AIG said today in a statement.

Warren takes on $4.45B of gross asbestos losses to go with the billions he’s already holding from CNA and Lloyd’s and XL and, hell, probably somebody’s grandma. (If he corners the market, will Justice file an antitrust action?)

In addition to the cash, he also gets the benefit of $2.8B in reinsurance protections that AIG had in place. Berkshire is responsible for losses stemming from uncollectible reinsurance. In all, the limit on this retroactive policy is $3.5B.

Meanwhile, AIG will book $200M profit. (Bloomberg makes it sound like the profit is booked this quarter, but accounting rules force it to be spread across a couple of years.) So it sounds like those asbestos reserves were sitting on AIG’s balance sheet for $1.85B net and $4.65B gross, though there might be some discounting action I’m missing.

At year-end, AIG carried gross asbestos losses of $5.53B and net of $2.2B. So AIG will still carry some asbestos reserves – maybe $880M gross and $375M net. Business Insurance notes the remaining asbestos reserves are booked at policy limits, so they can’t hurt AIG any more than they already have.

And unless everyone is being obtuse, AIG will still have about $127B in net environmental claims.

Wall Street Journal and others note this is part of a big last-minute cleanup before the federal government begins to sell its stake in AIG.

And that’s what makes the asbestos dump not-so-much of a surprise. When investors sink their money into a firm, they want it to go toward making tomorrow profitable. They don’t want it to pay for yesterday’s problems.

And with AIG’s recent bout with under-reserving ($4B+ last year), the popular press was reporting a bit of nervousness among investors.

Wednesday’s announcement is here. AIG’s 10K is here, with all the dirt around page 108. I bored you with this stuff before here.

From Aon Benfield, (h/t Business Insurance):

The Aon report actually emphasizes measuring reinsurer profitability (ROE, combined ratio by company, etc.). The whole report is here (pdf).

The Aon report actually emphasizes measuring reinsurer profitability (ROE, combined ratio by company, etc.). The whole report is here (pdf).