The Department of Health and Human Services largely rubber-stamped the NAIC’s recommendations for medical loss ratios. Recall these are the rules behind calculating that health insurers spend 80 cents of the premium dollar on providing medical services (85 cents for group health plans). Insurance Journal summarizes here.

Unhappy are the insurance agents. They wanted commissions left out of the formula, since that essentially caps their income. You can hear their complaints here. Though I wouldn’t be surprised if they find a way to, at least in some states, add placement fees. Agents routinely charge these in nonstandard auto markets (where the hard-to-insure find policies with low limits and low premiums).

Also, more people will be buying individual policies, so while commission rates may fall, agency revenues may actually increase.

You may think I am not too sympathetic to the agents’ plight, and you’d be right. Our health care system is so bloated that to fix it, everybody is going to have to take a financial hit – hospitals, doctors, insurers and, yes, agents.

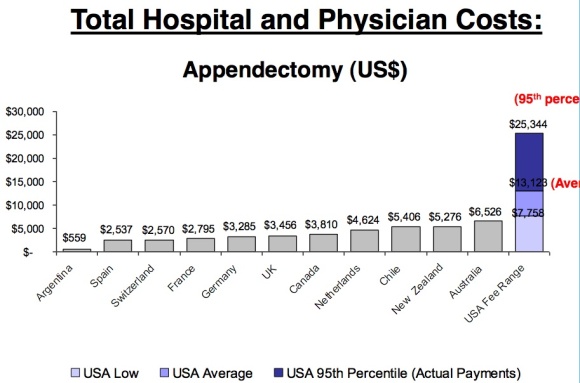

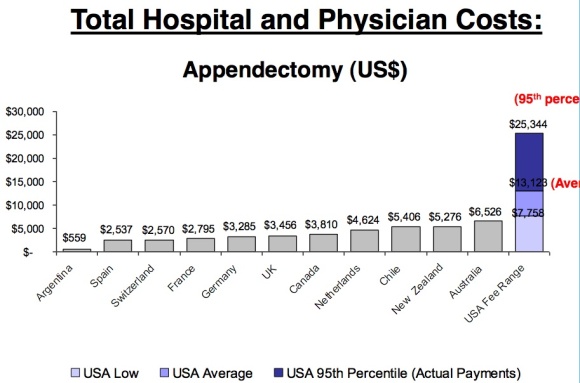

How bloated? Well, yesterday the International Federation of Health Plans published its annual comparison of health care costs across countries. Here’s a typical slide from the pdf:

Yeah, we pay twice as much as anybody else for an appendectomy.

Yeah, we pay twice as much as anybody else for an appendectomy.

And News-Insurances.com passes along the latest Commonwealth Fund report showing, basically, that we have the worst health care in the world:

Americans are the most likely to go without health care because of the cost and to have trouble paying medical bills even when insured, a survey of 11 wealthy countries found Thursday.

“The US stands out for the most negative insurance-related experiences,” the New York-based Commonwealth Fund, the private foundation that carried out the study, said in an accompanying statement.

The study found that a third of US adults “went without recommended care, did not see a doctor when sick, or failed to fill prescriptions because of costs,” it said.

That compares to as few as five to six percent in the Netherlands and Britain, according to the study.

Just remember as the next phase of the health care debate rolls out – any repeal of Obamacare returns us to this status quo.